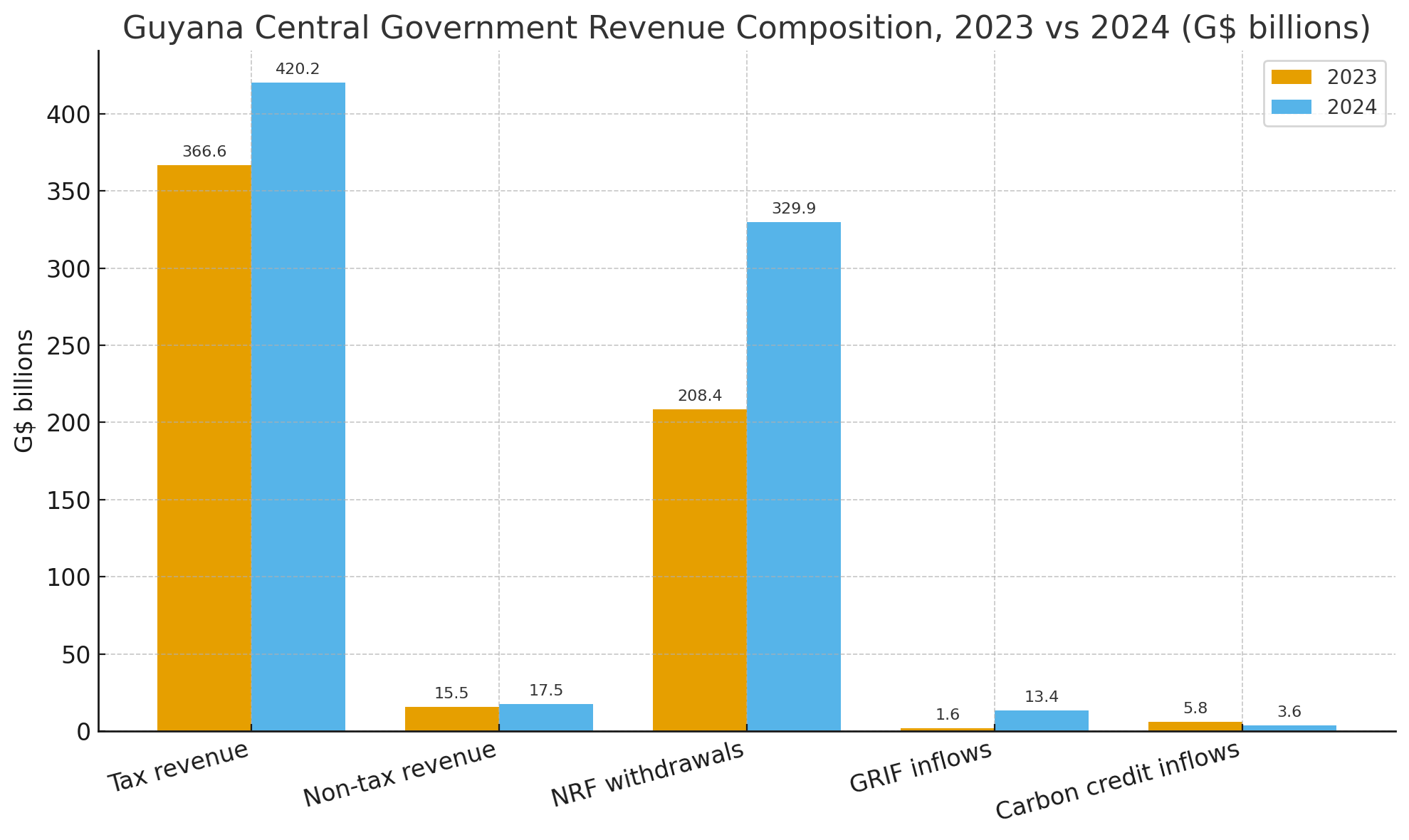

Guyana’s current revenue rose from G$597.9B to G$784.6B in 2024, which is US$2.87B to US$3.77B at 208:1. That is a 31.2 percent increase, powered by stronger tax collections and much larger withdrawals from the Natural Resource Fund (NRF) (Bank of Guyana, 2023; Bank of Guyana, 2024).

Two facts define the year. First, taxes still carried most of the budget. Second, oil money loomed larger in the cash mix.

The 2024 revenue mix

- Taxes: G$420.2B (US$2.02B) which equals 53.6% of current revenue in 2024, compared with G$366.6B(US$1.76B) or 61.3% in 2023 (Bank of Guyana, 2023; 2024).

- Non-tax revenue: G$17.5B (US$0.08B) or 2.2% in 2024, versus G$15.5B (US$0.07B) or 2.6% in 2023 (Bank of Guyana, 2023; 2024).

- NRF withdrawals: G$329.9B (US$1.59B) or about 42.0% in 2024, up from G$208.4B (US$1.00B) or 34.9% in 2023 (Bank of Guyana, 2023; 2024).

- Other inflows: GRIF was G$13.4B (US$0.06B) in 2024 vs G$1.6B (US$0.01B) in 2023. Carbon credit inflows were G$3.6B (US$0.02B) in 2024 vs G$5.8B (US$0.03B) in 2023 (Bank of Guyana, 2023; 2024).

-

The GRIF category in Guyana’s public accounts refers to the Guyana REDD+ Investment Fund.

-

It was set up in 2009, when Norway agreed to pay Guyana for verified reductions in greenhouse gas emissions from avoided deforestation.

-

The fund has since been the main vehicle for channeling international climate finance to Guyana, managed with the World Bank and other partners.

-

GRIF inflows are recorded in the Government’s revenue tables alongside NRF withdrawals and carbon credit payments.

-

-

Note on conversions: every G$ figure is paired with a USD value at 208:1 for readability. The official rate held near G$208.5 per US$1 in 2024; using 208 keeps the math simple for readers (Ministry of Finance, 2024).

What grew inside taxes

The tax base widened with the boom in construction, finance, and oil services.

- Income taxes climbed from G$211.8B (US$1.02B) in 2023 to G$249.2B (US$1.20B) in 2024, up 17.6%. Within that, private corporation tax reached G$89.7B (US$0.43B, +24.6%), withholding G$78.6B (US$0.38B, +14.6%), and PAYE G$77.1B (US$0.37B, +13.7%) (Bank of Guyana, 2023; 2024).

- VAT and excise rose from G$103.8B (US$0.50B) to G$112.7B (US$0.54B), up 8.6%, with VAT at G$80.2B(US$0.39B) and excise G$32.6B (US$0.16B) in 2024 (Bank of Guyana, 2023; 2024).

- Customs and trade taxes increased from G$34.8B (US$0.17B) to G$38.9B (US$0.19B), up 12.0%, driven by import duties on motor vehicles and building materials, with travel tax steady and export duties small (Bank of Guyana, 2023; 2024).

- Other taxable current revenue moved from G$16.2B (US$0.08B) to G$19.3B (US$0.09B), up 18.8%, led by property tax and the environmental levy (Bank of Guyana, 2023; 2024).

Taxes still paid most of the bills in 2024, though their share slipped to 53.6% because the NRF contribution climbed. Income, VAT, excise, and trade taxes all grew, which shows a broader private-sector footprint. The NRF supplied about 42% of current revenue in 2024, up from about 35% in 2023, which tells you how closely the budget now tracks oil production and price outcomes (Bank of Guyana, 2023; 2024).

References

Bank of Guyana. (2023). Annual report 2023. Georgetown, Guyana: Bank of Guyana.

Bank of Guyana. (2024). Annual report 2024. Georgetown, Guyana: Bank of Guyana.

Ministry of Finance. (2024). Mid-Year report 2024. Georgetown, Guyana: Government of Guyana.

All USD figures use 208:1 for easy comparison.