A foreign direct investment (FDI) is an investment made by a firm or individual in one country into business interests located in another country. The value of FDI inflows worldwide reflect a reduction to 1.3 trillion USD in 2019 from a peak of 2.03 trillion USD in 2015 by more than 37,000 multinational companies globally.

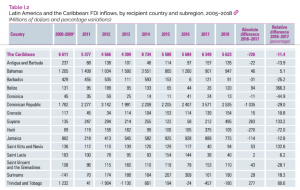

Like most emerging economies, the Government of Guyana (GoG) actively encourages foreign direct investment (FDI) and offers tax concessions for priority projects through its Guyana Office for Investment (GO-INVEST). According to the Bank of Guyana’s Half -Year Report for 2019, Guyana’s FDI increased from $514.8M to $826.4M, an increase of 60.5 percent, earning Guyana the number 3 spot in the Caribbean behind the Bahamas and Jamaica. Guyana’s recent growth in FDI was fuelled mainly by developments within the oil and gas sector and all the industries that support it.

FDI is important to emerging economies like Guyana because of its impact on economic growth resulting in more jobs, access to new technologies, access to improved management techniques, access to foreign markets, and financial resources. In the Guyana context, recent activities in developing a local content policy to help local companies take advantage of this business sector is projected to bring more benefits with every new foreign investment. Legislation to enforce the preliminary local content policy is still forthcoming, so the impact on oil and gas companies investing in Guyana is unknown.

Risks To Foreign Investors

Emerging economies like Guyana work to create an ideal environment for attracting foreign investors. This process includes paying keen attention to four major areas of risk which result in limited investments. These areas include; 1)price and cost uncertainty, 2)political instability, 3)infrastructure deficiencies and 4)market limitations. Generally speaking, the greater the risks, the lower the level of FDI. It should also be noted that significant competition for FDI investment exists among emerging economies. Investors are usually presented with a portfolio of potential investments in emerging economies representing various risks and must weigh and balance decisions based on the likelihood of achieving their projected returns on investment enabling them to maximize stockholder wealth. When faced with significant risks, companies will delay investments until more favorable conditions exist.

Economic risks center around host countries’ economic performance, especially inflation and exchange rate fluctuations. In 2020, the inflation rate for Guyana was 1 %. 2% or below is generally considered acceptable. Inflation is projected to increase as competition for labour in the marketplace increases, driving up wages across the board. In December of 2020, Minister of Labour Joseph Hamilton’s indication to raise the private sector minimum wage to $60,000 GY ($300 USD) monthly was rebuffed by PRIVATE Sector Commission (PSC) Chairman, Nicholas Boyer who indicated that he does not believe that the private sector is prepared just yet to accommodate an increase in the minimum wage, given the economic situation the country has faced over the past few months.”

The private sector minimum wage has not increased since 2017, when it was raised from $35,000 to $44,200 for a 40-hour week. Comparatively, the minimum wages for the public sector is currently $70,000.

Not only are Guyanese workers generally unhappy about existing wages, but as more foreign companies enter the marketplace for labour, wages are certain to increase substantially. My observation however is that there will be a significant increasing wage divide in the near term, as more qualified workers benefit from competition for their labour while lower skilled workers will continue to struggle for wage increases. In the medium term, even lower skilled workers are projected to benefit from wage increases as demand for service workers like hotel workers, security guards, and retail sales reps increase as the economy expands. Whether the wage gains for service workers are lost to inflation remains to be seen.

Political Instability–Guyana’s political instability index (-2.5 weak; 2.5 strong) is reported at -.24, the lowest rating since 2014, but some distance from a -2.5 maximum weakness rating. The index of Political Stability measures perceptions of the likelihood that the government will be destabilized or overthrown by unconstitutional or violent means, including politically-motivated violence and terrorism. The index is an average of several other indexes from the Economist Intelligence Unit, the World Economic Forum, and the Political Risk Services, among others. There seems to be no end in sight to the political wrangling between government and opposition, resulting in an ethnic divide where the opposition accuses government of ongoing discriminatory practices, undoing of contractual agreement agreed to by the coalition government, arbitrary firing of public servants, discriminatory practices in the distribution of the COVID-19 cash grants, alleged politically motivated charges and arbitrary arrests of persons perceived to be opposition supporters and other issues. The government continues to deny the allegations.

Investors generally balk at investing in countries with significant risk and where they proceed, emerging governments pay an economic premium as companies offset risks by insisting on longer term contracts, higher interest rates, and more economic concessions. Guyana’s politicians must show political maturity by working together to reduce the current factors which affect political instability in Guyana.

Legal Risks

Foreign investors are also concerned about the influence of institutional contracts-related risk factors, such as contract inviability or corruption. Where the former reflects an insufficient quality of a country’s legal system, the latter emphasizes the misuse of power by public officials. Regarding legal risks there are several categories worthy of mention;

- Inefficient court system plagued by corruption ( disappearing files, extensive delays in scheduling court dates)

- Perception of partisan judgements

- Antiquated commercial legal framework

- Undoing of, or rejection of contractual agreements

- Imprisonment of political enemies

The Government of Guyana must make clear to the world, a respect for democratic norms by strengthening the legal system and ensuring not only the reality but that the perception of a fair and balanced judicial system is in place. Investors must be assured that signed contracts are respected and that agreements signed under one government must be respected by another. It does not inspire investor confidence to operate in an environment where the courts can be used as a tool to exact revenge or can be swayed to the accommodations of one or the other political or otherwise powerful entities.

Infrastructure Deficiencies–FDI is more likely to occur in countries with good physical infrastructure such as bridges, ports, highways, internet, electricity, water, hospitals and schools. Coincidentally these are the very factors important to citizens living in emerging economies. Therefore, especially for countries with poor infrastructure, investing in improvements in infrastructure may be important for attracting foreign investors and pleasing citizens. Infrastructure also reflects an aggregate of passenger vehicles, telephones, and commercial vehicles all measured per 1000 population. Guyana’s infrastructure in all areas is in desperate need of expansion, improvement and maintenance. The costs of implementing and maintaining infrastructure tends to be exorbitant, but Guyana’s oil revenues, if invested wisely, will contribute significantly to the nationwide infrastructure upgrades that are desperately needed.

Finally, research demonstrates the importance investors place on being able to make long term estimates of profitability. While investors may rely on speculative perceptions of places’ risks rather than systematic analyses, they are for the most part quite good at formulating and executing corporate plans. In order to attract greater shares of FDI, Guyana must remove the uncertainties that multinational firms face when designing investment campaigns. This means that policies and programs must deliberately reduce the important risks investors face in the country.